How to add and convert a convertible note?

Learn how to add and convert a convertible note

A convertible note is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is typically a short-term debt, usually in conjunction with a future financing round. In effect, the investor loans money to a startup and instead of a return in the form of principal plus interest, the investor receives equity in the company.

To add investments to a portfolio company, you must be a VC admin or a VC member who has access to the fund to which your company is assigned.

1. Adding a convertible note

- Make sure you're in the APP side of the tool (top bar -> APP). Navigate to the left side menu and click the Investments page.

- Hit the button Add Transaction at the top right of the screen or click the plus icon next to a company you want to add an investment to.

- Select Convertible Note.

- Fill in the required information: Target company, Date of the transaction, Fund and Investment amount. You are also asked to add maturity date and information on the interest. As an optional information you can also select the Person responsible in case the person is a user on your Rundit account.

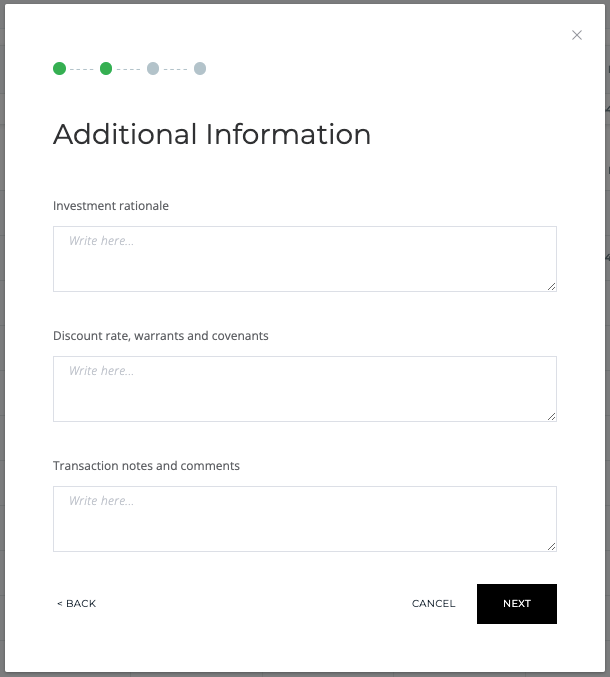

- Click Next to proceed to the Additional Information step.

In the Additional Information step, you’re able to elaborate details about the investment.

In the Additional Information step, you’re able to elaborate details about the investment.

- Investment rationale is an explanation for why an investment is worth making - a reasoned argument for a particular investment and how it fits your investment strategy.

- You can mention if there are any Discount rates, warrants or covenants. Transaction notes and comments can include anything related to that particular investment.

- Click Next to view the transaction summary > proceed either to the Ownership/ Valuation Update or funding round information (in case there is no previous equity update on the company, Rundit will skip the valuation update step).

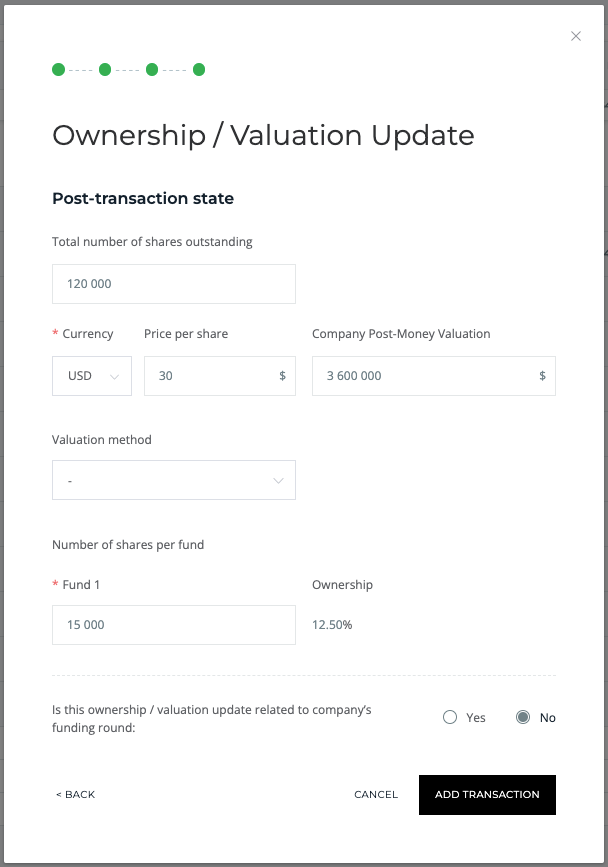

At the Ownership/ Valuation Update, you’re asked to determine the post transaction information on Total number of shares in the company, valuation method and funding round details.

At the Ownership/ Valuation Update, you’re asked to determine the post transaction information on Total number of shares in the company, valuation method and funding round details.

- Insert the amount of fully diluted shares to Total number of shares in the company. Rundit calculates the Company Post-Money Valuation based on the total number of shares in the company and price per share.

- The ownership is calculated based on the total number of shares owned by the fund and total number of shares in the company. If you’ve added an equity investment from multiple funds, you can see the number of shares and the ownership % in the company per each fund.

- Tick Yes to the question “Is this ownership / valuation update related to company’s funding round” to include information about the funding round in the transaction. You can enter the funding round, your role in the round and information on co-investors. To complete adding the investment, click the add transaction button.

2. Converting a convertible note

After adding a convertible note to Rundit, you’re able to convert it by clicking on the convert button next to the initial transaction.

- Choose the conversion date, after that you have three options: Convert to Equity, Payback or Write off.

- Press next to confirm the note state at the time of conversion: you can edit the Principal and Accumulated interest still at this point. If you are converting the note to equity, you’ll be asked for details about the number of shares to be acquired, price per share and amount converted to equity.

- Press next to write additional information about the transaction.

- In the next steps, you’ll get a display of the transaction summary, followed by Ownership / Valuation Update. You can add funding round details also for this conversion transaction by ticking YES to the question "Is this ownership / valuation update related to company’s funding round." Click add transaction to complete the note conversion.